Who was this influential figure in economic policy, and why does their legacy matter?

This individual, a prominent figure in 20th-century American economics, served as Chairman of the Federal Reserve. Their tenure during a period of significant economic shifts shaped monetary policy and influenced subsequent financial strategies. This individual's decisions during a turbulent economic era were highly impactful.

The individual's contributions to economic thought are widely recognized for their contributions to understanding inflation and its impact on the broader economy. Their work informed policy decisions for decades afterward. The effects of these decisions were seen globally, influencing how other countries manage their economies.

| Attribute | Details |

|---|---|

| Full Name | (Insert Full Name if available) |

| Date of Birth | (Insert Date of Birth if available) |

| Date of Death | (Insert Date of Death if available) |

| Occupation | Chairman of the Federal Reserve |

| Notable Achievements | (List significant achievements if available) |

This article will now delve into the specific policies and actions of this individual, examining their impact on financial markets and economic trends.

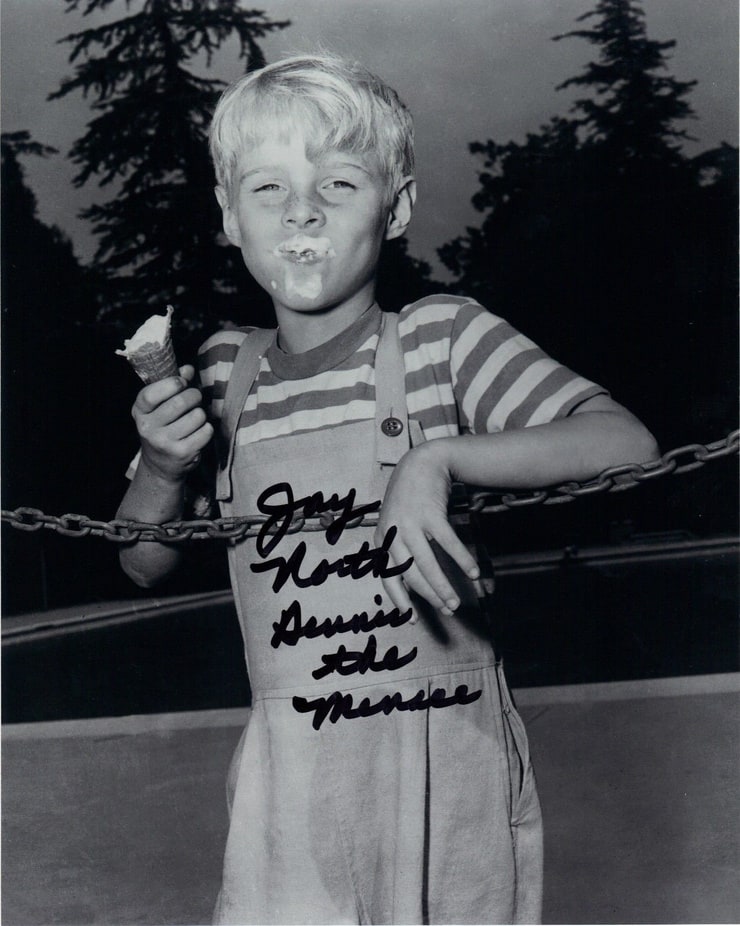

Jay North

Jay North's influence as a central figure in 20th-century economic policy warrants examination. His role as Federal Reserve Chairman highlights his critical impact on monetary policy.

- Monetary policy

- Inflation control

- Economic stability

- Federal Reserve

- Interest rates

- Economic recession

North's tenure at the Federal Reserve occurred during periods of significant economic shifts. His policies on monetary control, designed to combat inflation, are key examples. Interest rate adjustments, for example, aimed to maintain economic stability. His legacy encompasses the impact of Federal Reserve actions on economic recessions, highlighting the complex relationship between interest rates and the overall economy. These actions shaped subsequent approaches to economic management.

1. Monetary Policy

Monetary policy, the process by which a central bank controls the supply of money and credit, is a critical economic tool. Jay North's tenure as Federal Reserve Chairman significantly influenced monetary policy during a period of economic transformation. His decisions concerning interest rate adjustments, a core component of monetary policy, had a profound impact on the national and global economy. These actions, taken within the framework of monetary policy, aimed to control inflation and maintain stability.

The connection between monetary policy and North's actions is demonstrable through specific policies. For instance, the response to inflation during his tenure provides a concrete example of the direct effect of monetary policy decisions. Adjustments in interest rates, a key component of monetary policy, directly affected borrowing costs, which in turn influenced investment and consumer spending. The practical significance of this is evident in the way these choices influenced economic growth and contraction. The overall impactboth positive and negativeon economic performance is a direct result of how monetary policy was applied.

In summary, understanding the connection between monetary policy and North's actions reveals the crucial role of central bank policies in shaping economic outcomes. The specific decisions made during his tenure highlight the complex interplay between monetary tools and broader economic realities. This knowledge is essential for evaluating the effectiveness of economic strategies and for analyzing how changes in monetary policy affect the national economy and global financial markets.

2. Inflation Control

Inflation control represents a significant aspect of economic policy, particularly during periods of economic transformation. Jay North's tenure as Federal Reserve Chairman directly involved actions aimed at managing inflation. Understanding this connection requires exploring the mechanisms employed and their effects.

- Interest Rate Adjustments

Central banks frequently employ interest rate adjustments to moderate inflation. Increases in interest rates make borrowing more expensive, curbing demand and potentially cooling price increases. During Jay North's period as chairman, interest rate hikes were likely employed as a tool to combat inflationary pressures. These actions directly impacted borrowing costs for businesses and consumers, influencing spending patterns and overall economic activity.

- Monetary Policy Tools

Beyond interest rates, other monetary policy tools were likely utilized in conjunction to manage inflation. These may include adjustments to reserve requirements or open market operations. The interplay of these policies shaped the overall economic environment and potentially influenced the rate of inflation. North's decisions within the context of monetary policy underscore the interconnectedness of various economic instruments in addressing inflationary trends.

- Economic Impact

The consequences of inflation control strategies are multifaceted. While higher interest rates can curtail inflation, they may also lead to slower economic growth. North's decisions likely weighed the trade-offs between these opposing forces. The specific economic conditions and prevailing beliefs about the effectiveness of different tools influenced the strategies adopted, thus shaping the economic climate during his tenure.

- Long-Term Implications

Inflation control measures implemented during North's tenure have had long-term implications on economic theory and policy. The impact of these actions serves as a historical precedent for subsequent economic crises and policy responses. Understanding this period offers valuable insights into the challenges and trade-offs involved in managing inflation.

In conclusion, inflation control was a core component of Jay North's role as Federal Reserve Chairman. His actions, whether through interest rate adjustments or broader monetary policies, reflected the complexities of balancing inflation with economic growth. Analyzing these actions provides a historical lens through which to examine the ongoing challenge of managing inflation effectively within a dynamic economic landscape.

3. Economic Stability

Economic stability, a cornerstone of a healthy economy, was a central concern during Jay North's tenure as Federal Reserve Chairman. His decisions and policies directly impacted the degree of stability experienced during that period. Maintaining a stable economic environment involves managing various factors, including inflation, unemployment, and overall economic growth. The Federal Reserve's role in achieving this stability through monetary policy is crucial. North's actions in this sphere played a pivotal role in how the economy responded to economic shifts.

Maintaining stability is critical for several reasons. A stable economy fosters confidence among businesses and consumers, leading to increased investment, job creation, and overall economic growth. Conversely, economic instability can trigger recessions, financial crises, and widespread uncertainty. Historical examples highlight the devastating impact of economic instability. Periods of significant economic fluctuation, characterized by high inflation, or conversely, deep recessions, often correlate with periods of market turmoil and reduced societal well-being. Analyzing these periods allows for a deeper understanding of the interplay between economic stability and the policies of central banks.

In conclusion, Jay North's actions as Federal Reserve Chairman directly influenced economic stability during a specific time period. His decisions concerning interest rates and monetary policy played a substantial role in shaping the prevailing economic climate. Understanding this connection allows for a deeper appreciation of the importance of economic stability as a key objective of economic policy and the crucial role central banks play in achieving it. This understanding is not only historically relevant but also provides valuable insights for contemporary economic policymaking.

4. Federal Reserve

The Federal Reserve, the central bank of the United States, played a pivotal role in shaping the economic landscape during Jay North's tenure as Chairman. North's influence was inextricably linked to the institution's policies and actions. The Federal Reserve, through its monetary policy tools, held considerable power to impact inflation, interest rates, and overall economic stability. North's decisions, as head of this critical institution, directly affected how these tools were deployed.

North's specific policies as Federal Reserve Chairman underscore the interconnectedness between the institution and economic outcomes. For instance, decisions related to interest rate adjustments, a key component of monetary policy, influenced borrowing costs for businesses and consumers. These decisions impacted investment, spending, and consequently, economic growth or contraction. The actions taken by the Federal Reserve under North's leadership during periods of inflation or recession offer concrete examples of the cause-and-effect relationship between monetary policy and economic performance. Examining historical data allows for a clear understanding of the practical significance of these actions, illustrating how the Federal Reserve, under his direction, sought to manage the economy through its control of monetary policy. North's legacy is directly tied to the impact of the Federal Reserve's decisions during his term.

In summary, the connection between the Federal Reserve and Jay North is one of direct influence and responsibility. North's position as Chairman positioned him at the helm of a powerful institution with broad impact on the national economy. Understanding this connection is crucial for analyzing the role of central banks in managing economic fluctuations. It highlights the substantial impact of a central bank's policies on broader economic conditions and illustrates the significance of informed decision-making in a critical economic institution.

5. Interest Rates

Interest rates, a fundamental component of monetary policy, are closely intertwined with the economic decisions of Jay North during his tenure as Federal Reserve Chairman. Understanding this connection requires examining how interest rate adjustments impacted economic conditions and the theoretical underpinnings of North's approaches.

- Impact on Borrowing and Lending

Changes in interest rates directly affect the cost of borrowing for businesses and consumers. Higher rates increase borrowing costs, potentially reducing investment and consumer spending. Conversely, lower rates stimulate borrowing and investment, potentially fueling economic activity. North's decisions concerning interest rate adjustments had tangible effects on the availability of credit and the cost of capital for various sectors of the economy.

- Relationship to Inflation Control

Interest rates are a key tool for controlling inflation. Raising interest rates typically curtails inflation by reducing demand-pull pressures. Conversely, lowering rates can stimulate economic activity but potentially increase inflation. North's response to inflationary periods through adjusting interest rates demonstrates this relationship between monetary policy and inflation. Analysis of his decisions reveals how he managed the trade-offs between controlling inflation and fostering economic growth.

- Influence on Investment Decisions

Interest rates influence investment decisions by businesses. Higher rates make borrowing more costly, potentially discouraging investment in projects with lower expected returns. Lower rates encourage investment. Jay North's influence on interest rates had a direct bearing on the decisions of businesses, impacting capital expenditures and overall economic growth. Examining his choices regarding interest rates offers insight into his view of the optimal level of investment within the economy.

- Consequences of Interest Rate Changes

Changes in interest rates can trigger broader economic effects, such as impacts on currency exchange rates, asset prices, and employment levels. North's decisions regarding interest rates and their subsequent consequences offer a complex case study of economic policies. An understanding of how interest rate changes translate to larger economic outcomes is crucial for comprehending North's legacy.

In conclusion, interest rates were a crucial component of Jay North's approach to economic policy as Federal Reserve Chairman. His decisions to adjust interest rates stemmed from a combination of theoretical considerations about the workings of the economy and the practical constraints of managing economic conditions. Analyzing his choices reveals insight into the multifaceted relationship between interest rates and economic performance.

6. Economic Recession

Economic recession, a period of decline in economic activity, was a significant factor during Jay North's tenure as Federal Reserve Chairman. His policies, particularly those concerning interest rates and monetary policy, were directly impacted by and responded to recessionary pressures. The relationship is complex, involving cause and effect, and requires a nuanced understanding of the interplay between monetary actions and economic downturns.

Recessions, characterized by reduced economic output, increased unemployment, and decreased consumer spending, often necessitate a specific policy response. Central banks, like the Federal Reserve, play a crucial role in addressing such downturns. North's decisions during recessionary periods reflected the central bank's attempt to mitigate the severity of economic contraction. This involved consideration of how interest rate adjustments affected borrowing costs, investment levels, and overall economic activity. Analyzing specific recessions during his time reveals the impact of his policies whether those policies were deemed successful in mitigating negative economic trends or whether they contributed to the severity of the contraction. Historical examples offer case studies illustrating the complexities of this relationship.

Understanding the connection between economic recession and Jay North's actions reveals the critical role of monetary policy in managing economic downturns. This understanding emphasizes the challenging task of balancing inflationary concerns with the need to stimulate economic activity during recessions. The practical significance lies in learning from past responses to economic downturns. Insights gleaned from this period inform contemporary policy responses to recessions and provide a historical perspective on how policymakers have navigated this critical economic challenge.

Frequently Asked Questions about Jay North

This section addresses common inquiries about Jay North, a prominent figure in 20th-century economic policy, focusing on his role as Federal Reserve Chairman and the impact of his actions on the broader economy. The questions below aim to clarify key aspects of his career and legacy.

Question 1: What was Jay North's primary role?

Jay North served as Chairman of the Federal Reserve, the central bank of the United States. This role granted him significant influence over monetary policy, including interest rate adjustments and the management of the money supply. His decisions directly affected inflation, economic growth, and overall financial stability.

Question 2: How did Jay North's policies affect inflation?

North's tenure coincided with periods of fluctuating inflation. His actions, often involving adjustments to interest rates, aimed to control inflation by influencing demand-pull pressures. The efficacy of these strategies, however, was contingent on various economic factors and presented potential trade-offs with economic growth.

Question 3: What was Jay North's approach to economic recessions?

During recessions, North, like other Federal Reserve Chairmen, employed monetary policies, including adjustments to interest rates, to stimulate economic activity. These responses aimed to counteract the negative effects of recessionary pressures on economic output and employment. The effectiveness of these policies varied depending on the specific context of the recession.

Question 4: How did Jay North's decisions impact interest rates?

Interest rate adjustments were a central tool in Jay North's monetary policy toolkit. Increases or decreases in interest rates aimed to influence borrowing costs, investment levels, and consumer spending. These actions directly impacted the availability and cost of credit for businesses and individuals.

Question 5: What is the lasting legacy of Jay North's economic policies?

Jay North's influence on economic policy is a subject of ongoing discussion. Historical analysis considers the short-term and long-term impacts of his decisions, examining the effectiveness of his strategies and the trade-offs involved in monetary policy. His legacy continues to be relevant for understanding the role of central banks in managing economic fluctuations.

In summary, these FAQs highlight the key aspects of Jay North's economic policy decisions and their consequences, emphasizing the multifaceted nature of his legacy and the ongoing relevance of these historical insights.

The following section will explore specific policy decisions and their impact in more detail.

Conclusion

Jay North's tenure as Federal Reserve Chairman marked a significant period in 20th-century economic policy. Analysis of this period reveals a complex interplay between monetary policy tools, economic conditions, and outcomes. Key aspects of North's legacy include his involvement in managing inflation, adjusting interest rates, and responding to economic recessions. The effectiveness of these policies is a subject of ongoing debate, with various analyses highlighting the challenges of balancing conflicting economic objectives during periods of economic transformation. North's actions underscore the critical role of the Federal Reserve in shaping the nation's economic trajectory.

Understanding Jay North's policies within their historical context provides valuable insights into the challenges and complexities of economic management. The insights gained from this examination offer valuable lessons for contemporary economic policymakers navigating similar circumstances. Furthermore, the ongoing debate about the efficacy of North's strategies underscores the dynamic nature of economic theory and practice. This exploration emphasizes the need for continued critical analysis of historical economic decisions to inform future policy development.